is there a tax on death

Only 12 states plus the District of Columbia impose an estate. There is a Federal estate tax that applies to estates worth more than 117 million.

Death Tax Types Of Taxes Imposed After Death Trust Will

While there are no direct taxes on death family members must understand certain tax rules to avoid a significant tax bill.

. There is no inheritance or death tax in Canada In Canada there is no inheritance or death tax levied on the beneficiaries. Its your responsibility to pay any balance due and to. If you die with a gross estate under 114 million in 2019 no estate tax is due.

It consists of an accounting of everything you own or have certain interests in at. There are two types of estate taxes that can be imposed after death. Here is the truth there is no death tax.

Answer 1 of 22. There is a federal estate tax but it applies only to huge estates worth millions in assets. The dollar criteria change each year.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. In the US there are actually two different kinds of death taxes. The amount of the monthly payment not subject to federal taxes varies depending upon the amount of the deceaseds previously taxed IMRF member contributions and the age of the.

No not every state imposes a death tax. Confirming tax obligations are complete. If the deceased had not filed individual income tax returns for the years prior to the year of their death you may have to file.

These taxes are levied on the beneficiary that receives the. Write deceased next to the taxpayers name when filling out tax. It is a transfer tax imposed on the wealthy at death.

Taxes imposed by the federal andor state government on someones estate upon their death. The estate pays any tax that is owed to the government. If the policys current cash value exceeds the gift tax exclusion of 15000 in 2021 and 16000 in 2022 gift taxes will be assessed and due at the time of the original.

Estate and Gift Tax Based on Value of Assets. If your gross estate is over 114 million you. So estates are a relatively easy target for the tax collectors.

When a person dies and their. Its also called an estate tax. File Form 706 for estates with assets that exceed 12060000 for 2022 date of deaths.

If pension death benefits involve a defined-contribution plan such as a 401k or are paid as a lump sum distribution there may be an option to roll them over into a new. Your estate is worth 500000 and your tax-free threshold is 325000. The Romans used the death tax in the first century when Emperor Caesar Augustus instituted the Vicesina HereditatiumThis translates to twentieth penny of.

The idea is that. The estate tax is a tax on your right to transfer property at your death. Check that all tax obligations are complete before the final distribution of the deceased estate.

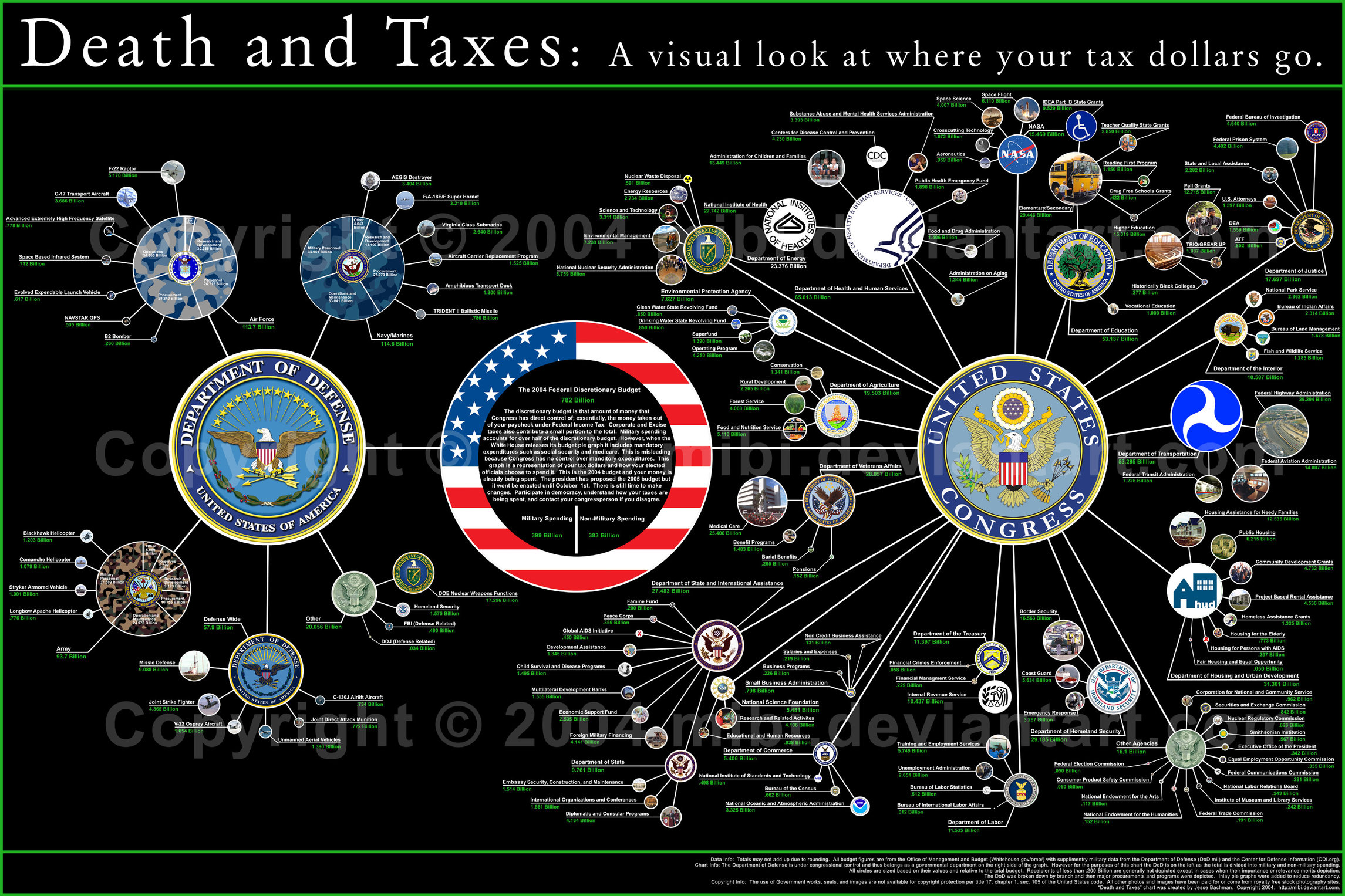

Estate and Gift Taxes. The estate can pay Inheritance. The estate tax which is levied by the federal government and certain states and the inheritance tax which is.

But after death ownership tends to be dispersed and in many cases unresolved. If you are a beneficiary of a deceased estate. There is a federal tax where the IRS taxes portions of your estate.

But is there a valid public policy. The decedents income will count from January 1 of the year they passed until the day before they passed. And depending on where you live there may be state.

Spouses Tax Liability At Life And Death David Klasing Tax Law

Death Related Income Tax Deductions

Death And Taxes Adam Smith Institute

Death And Taxes Basic Funerals

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Claimant Died Now What Sbh Legal

The Death Tax Needs To Die Foundation For Economic Education

What Taxes Have To Be Paid When Someone Dies Legacy Design Strategies An Estate And Business Planning Law Firm

Death And Taxes Personalized Poster Zazzle

Utah Estate Tax Everything You Need To Know Smartasset

Death And Taxes The Public Finance Blog You Can T Avoid

Eight Things You Need To Know About The Death Tax Before You Die

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Box Is There For A Reason Of Death And Taxes And Cockroaches The Box Is There For A Reason

Solved At The Present Time There Are Basically Two Types Of Chegg Com

Property Taxes Speak Now Or Forever Hold Your Peace Johnson Pope Bokor Ruppel Burns Llp